Exploring Different Types of Medical Health Insurance Plans

The realm of medical health insurance stands as a safeguard against the unpredictable and often exorbitant expenses that can accompany medical care. In a world teeming with diverse health insurance options, choosing the ideal plan tailored to your unique requirements can be a formidable task. This introduction serves as a guide to elucidate the myriad medical health insurance plans available, their scope of coverage, and the method to select the most suitable plan.

Types of Health Insurance

The tapestry of health insurance is woven from multiple threads, each offering protection against the vagaries of medical expenses. We shall embark on a journey through the various types of health insurance, exploring their inner workings and the gamut of healthcare services they encompass.

Group Health Insurance: Provided by employers or organizations, group health insurance extends its protective embrace over the members of the group. The risk is diffused across a larger collective, rendering these plans cost-effective. Typically, this type of medical health insurance plan encompasses fundamental medical expenses like doctor consultations, hospital admissions, prescription medications, and preventative services, such as immunizations and screenings.

Individual Health Insurance: Tailored for individuals or families lacking access to employer-sponsored group coverage or those seeking greater coverage flexibility, individual health insurance offers a wealth of choices. Consumers can select from a spectrum of benefit packages designed to dovetail with their unique needs.

High Deductible Health Plans (HDHP): Engineered to reduce premiums in exchange for higher out-of-pocket costs when availing medical services such as office visits or hospital stays, high deductible health plans empower consumers to pay all expenses up to their annual deductible.

Benefits of Health Insurance

In an era marked by escalating healthcare costs, health insurance emerges as a vital necessity for countless individuals and families. Beyond the assurance of financial protection against unexpected medical bills, the benefits of health insurance unfurl in a plethora of ways.

Access to Quality Healthcare: Health insurance unfurls the gateway to healthcare, endowing individuals with access to doctors and specialists who might remain beyond reach without insurance. Routine check-ups and preventive care, including vaccinations and physical examinations, are embraced under the umbrella of coverage. This proactive approach helps identify potential health issues before they burgeon into serious and costly afflictions.

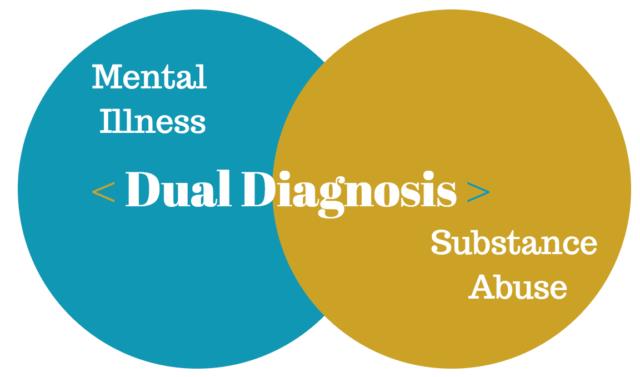

Financial Protection: Health insurance furnishes a shield against the financial maelstrom precipitated by unforeseen medical expenses. These plans encompass both inpatient and outpatient services, spanning hospitalizations, emergency room visits, doctor consultations, and diagnostic tests such as X-rays and MRIs. The coverage often extends to mental health services, encompassing counselling and therapy sessions.

Catastrophic Protection: Health insurance serves as a guardian against catastrophic healthcare costs that could otherwise deplete savings or plunge individuals and families into debt. In the event of severe illnesses or major accidents, health insurance provides a safety net, ensuring that the financial burden remains manageable.

Cost and Coverage Considerations

The dynamic duo of cost and coverage assumes paramount importance when navigating the labyrinth of health insurance plans. Understanding the nuances of each plan can empower individuals to make informed decisions based on their unique coverage needs and financial constraints.

Cost: Health insurance plans vary in terms of premiums, deductibles, copayments, and coinsurance. These variables collectively influence the overall cost of the plan. Comparing these costs across different plans is essential to determine which aligns with one’s needs without stretching their budget. Moreover, it’s imperative to consider additional costs such as prescription drug coverage or vision care services, as these can exert a significant impact on the overall expenditure.

Coverage: Different health insurance plans extend diverse levels of coverage, encompassing preventive care services like check-ups and vaccinations, as well as comprehensive medical treatments, including hospital stays and surgeries. To ascertain that they receive the desired level of coverage at an affordable rate, individuals should review each plan’s roster of covered services. Many plans further sweeten the deal by offering additional benefits such as mental health counselling or telemedicine services.

Choosing the Right Plan for You

Selecting the right health insurance plan demands careful consideration of multiple factors. The journey begins with a comprehensive self-assessment to determine individual and family needs, followed by a meticulous comparison of plans based on specific criteria.

Assess Your Needs: The journey begins by assessing your unique coverage needs. Is the coverage intended for an individual or a family? Are there any specific medical conditions or treatments requiring special attention? Deliberate on the type of treatment and care that would best meet these needs.

Compare Plans: After delineating your requirements, embark on a comparison of health insurance plans. Scrutinize factors such as premium costs, deductibles, co-pays, and out-of-pocket maximums. Additionally, inquire about prescription drug coverage and the availability of preventive care services at an affordable rate. Investigate the reputation of the insurer in terms of customer service and the quality of providers within your locality.

Additional Benefits: Don’t overlook the prospect of additional benefits that some plans offer. These may include vision or dental coverage, or even long-term disability insurance. Some benefits are often included without extra charges, enhancing the overall value of the chosen plan.

In conclusion, medical health insurance occupies a pivotal position in shielding individuals and families from the financial aftershocks of illness or injury. Adequate coverage is essential to ensure financial security during uncertain times. The numerous benefits of health insurance, spanning access to quality healthcare, peace of mind, and protection from catastrophic expenses, highlight its indomitable significance in modern life.